SOL Price Prediction: Will SOL Hit $200 Amid ETF Hype?

#SOL

SOL Price Prediction

SOL Technical Analysis: Key Indicators to Watch

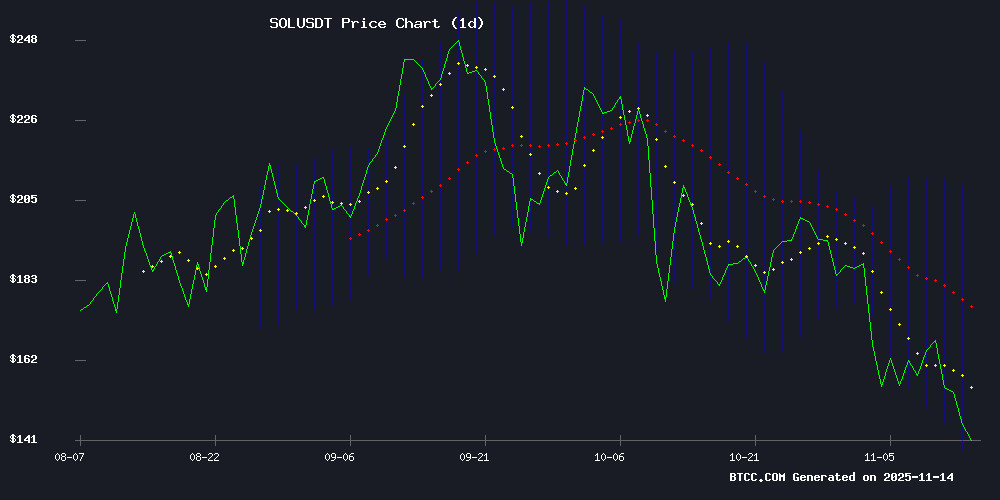

According to BTCC financial analyst Sophia, SOL is currently trading at $140.75, significantly below its 20-day moving average of $170.83, indicating a bearish short-term trend. The MACD shows a bullish crossover with the signal line at 14.84 and the MACD line at 20.52, suggesting potential upward momentum. However, the price remains NEAR the lower Bollinger Band at $134.15, which could act as support. A break above the middle band at $170.83 may signal a trend reversal.

Market Sentiment Boosted by ETF Developments

BTCC financial analyst Sophia highlights that VanEck's solana ETF clearing its final SEC hurdle and BlackRock's BUIDL Fund expanding to BNB Chain are major bullish catalysts. These developments could drive institutional interest and liquidity into SOL, potentially pushing the price higher. The market sentiment appears optimistic, aligning with the technical outlook of a possible rebound.

Factors Influencing SOL’s Price

BlackRock's BUIDL Fund Expands to BNB Chain in Major Blockchain Finance Integration

BlackRock's USD Institutional Digital Liquidity Fund (BUIDL) has extended its reach to BNB Chain, marking a pivotal convergence of traditional finance and blockchain liquidity. The integration enables Binance traders to utilize BUIDL as off-exchange collateral, unlocking new yield-bearing opportunities while maintaining dollar parity.

The fund now spans multiple ecosystems including Ethereum, Solana, and Polygon, with Securitize handling tokenization. This multi-chain approach positions BUIDL as critical infrastructure for institutional onchain finance, offering regulated exposure to tokenized U.S. Treasuries across decentralized networks.

BlackRock's collaboration with Binance signals growing institutional demand for blockchain-based financial instruments. The partnership enhances capital efficiency while preserving BUIDL's stable value proposition - combining the security of Treasuries with the flexibility of digital assets.

VanEck’s Solana ETF Nears Launch as SEC Filing Clears Final Hurdle

VanEck has submitted the final Form 8-A to the U.S. SEC for its Solana ETF, marking the last step before the product begins trading. The filing follows an amended S-1 that disclosed a 0.30% management fee and outlined staking strategies for SOL.

Solana ETFs have attracted $370 million in net inflows since Bitwise’s BSOL ETF launched, with $1.49 million recorded in a single day last week. The approval signals growing institutional interest in Solana as a yield-generating asset.

VanEck Advances Toward U.S. Solana ETF Launch With Final Regulatory Filing

VanEck has filed its Form 8-A with the SEC, a critical step toward launching its spot Solana ETF in the U.S. The submission suggests trading could commence within days, pending regulatory clearance. The fund will employ a staking strategy via SOL Strategies to generate yield for investors.

Institutional demand for Solana remains robust, with U.S.-listed spot ETFs extending their inflow streak to 13 days and accumulating $370 million in total inflows. VanEck's updated S-1 filing revealed a 0.30% management fee, positioning the fund as a competitive vehicle for Solana exposure.

Will SOL Price Hit 200?

BTCC analyst Sophia suggests that SOL's path to $200 depends on reclaiming key technical levels and sustained ETF-driven demand. Below is a summary of critical metrics:

| Indicator | Value | Implication |

|---|---|---|

| Current Price | $140.75 | Bearish short-term trend |

| 20-Day MA | $170.83 | Break above needed for reversal |

| Upper Bollinger Band | $207.51 | Potential target if bullish momentum continues |

With strong ETF news and MACD momentum, $200 is achievable but requires holding above $170 first.

- Technical Momentum: MACD bullish crossover supports upward potential.

- ETF Catalysts: VanEck's approval and BlackRock's expansion may fuel institutional inflows.

- Key Resistance: $170.83 (20-day MA) is the critical level to watch for a breakout.